Getting your Importer Exporter Code (IEC) has never been easier with us. We take pride in being one of the leading IEC consultants, catering to clients across India. We've streamlined the IEC application process, so you can say goodbye to the lengthy and complex procedures. Our commitment is backed by a 100% guarantee – we ensure your IEC is approved without a hitch, and if, by a rare chance, it faces rejection, we'll refile it at no extra cost. Simply share your document scans online, and you can expect your IEC code in just 1 to 2 working days. Your time and satisfaction matter most to us, and we're dedicated to making the IEC application straightforward and hassle-free.

Apply for Importer Exporter Code Online

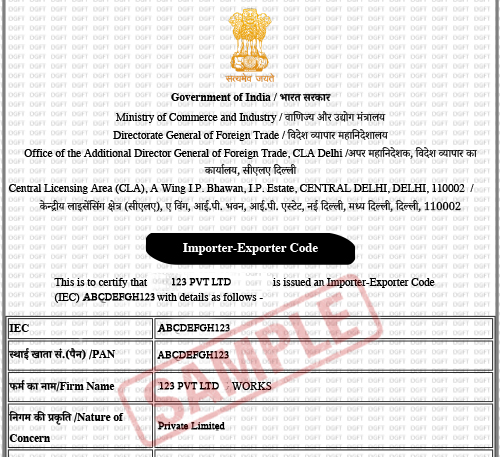

What is an Importer Exporter Code (IEC)?

An Importer Exporter Code (IEC) is a 10-digit identification number issued by the Directorate General of Foreign Trade (DGFT), a government authority in India. It is mandatory for anyone engaged in the import or export of goods and services to obtain an IEC. This unique code is used to track foreign trade transactions and is essential for clearing customs, opening an international bank account, and availing various benefits and incentives provided by the government.

Documents required for IEC (Import Export Code) registration

For IEC Code Registration, you will need to provide the following documents:

1. A copy of the PAN Card for individuals, firms, or companies.

2. Voter ID, Aadhaar card, or passport copy for the proprietor.

3. Documentation proving the establishment, incorporation, or registration of your entity, whether it’s a partnership, society, proprietorship firm, company, HUF, etc.

4. Proof of the address of your business premises, which can include a sale deed, lease deed, rent agreement, or utility bills (such as electricity, telephone, or mobile bills).

5. Copies of canceled checks for the current bank accounts belonging to individuals, firms, or companies.

6. A self-addressed envelope to facilitate the delivery of the IEC certificate via registered post.

TALK TO OUR EXPERTS FOR YOUR

RCMC REGISTRATION

Why Choose Us for Your IEC Application?

- Online Convenience: Our platform is designed to simplify the IEC application process, allowing you to complete it from the comfort of your home or office. No more standing in long queues or dealing with paperwork.

- Quick Processing: We understand the importance of a timely IEC approval. Our streamlined process ensures that your application is processed promptly, getting you your IEC in the shortest possible time.

- Expert Assistance: Our team of experienced professionals is available to assist you throughout the application process. If you have any questions or need guidance, we’re here to help.

- Secure and Confidential: We prioritize the security and confidentiality of your personal and business information. Rest assured that your data is handled with the utmost care and security.

How it Works

Contact Us

Reach out to us, and our team will be ready to assist you through the entire process.

Application Submission

Provide the necessary documents and information, and we will handle the rest.

Swift Processing

With our commitment to speed, you can expect your IEC code within 1 to 2 working days.

Frequently Asked Questions (FAQs) About IEC Code with Tax Mother

An IEC Code, or Import Export Code, is a 10-character alphanumeric code issued by the DGFT (Director General of Foreign Trade). You need it for any import or export activities, as it is a mandatory requirement. It acts as a unique identification for your business in international trade.

Initially, an IEC is valid for one year, as per DGFT’s new guidelines. It’s crucial to renew it annually to avoid cancellation. Tax Mother will assist you in keeping your IEC up-to-date.

No, only one IEC Code can be associated with a single PAN card.

Tax Mother will help you navigate the transition to e-IEC. For those who initially obtained IEC through the physical process, you can obtain your e-IEC certificate by applying with the necessary documents.

Yes, you can modify IEC details online. Tax Mother will guide you through the process, which includes resubmitting the required documents with the necessary changes.

No, you do not need to file any returns for the IEC. It’s a one-time process that simplifies your involvement in import and export activities.

Absolutely. Tax Mother can help you apply for a duplicate e-IEC certificate, provided you have all the necessary documents. DGFT will then issue you a certificate in the new electronic format.

Tax Mother simplifies the IEC application process, ensuring you get your code swiftly and without hassle. We offer expert guidance, quick processing, and a 100% satisfaction guarantee.

Specialized Services

Our specialized services at TaxMother are meticulously designed to cater to your unique financial needs. From tax consultation and accounting to business incorporation and financial planning, we offer a comprehensive range of solutions that empower individuals and businesses to achieve their financial goals with confidence. Our commitment to excellence and deep expertise in the financial domain make TaxMother your trusted partner in the world of taxation and financial management.

Address List

- NIT 3, Faridabad

- +91 95600 62020

- info@applyforiec.com

Social Networks

Links List

a subsidiary of

TAX MOTHER

Your Trusted Compliance Partner

+91-95600 62020

+91-95600 62020  info@applyforiec.com

info@applyforiec.com  Mon-Fri 9:00 AM – 7:00 PM

Mon-Fri 9:00 AM – 7:00 PM